Refund annuity with balance paid to beneficiary as a lump sum

Also known as a modified cash refund annuity, this payment form is typically used by contributory pension plans where a plan participant’s contributions (typically with interest) are due to his/her beneficiary(ies) in the event he/she dies before receiving all of the contributions in the form of annuity payments. In ProAdmin, this guaranteed amount is entered in the payment form as a Benefit Formula Component. Note: joint refund annuities are discussed below as they incorporate a modified cash refund in the formula.

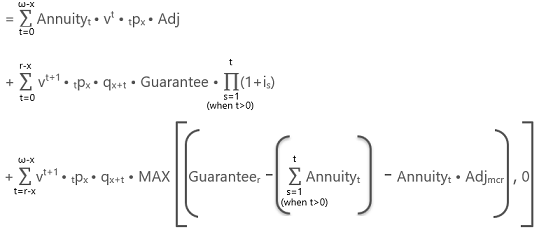

The total refund annuity payment form value at any commencement date is the sum of two values:

-

The value of the single life annuity payment, contingent on the member’s survival.

-

The value of the lump sum payment for any remaining cash refund, contingent on the member’s death.

If the guaranteed amount contains an interest bearing benefit formula component type (i.e., a cash balance accrual definition), then it will increase during the deferral period, if any, in accordance with the interest rates specified for the benefit formula component. Once annuity payments commence, interest is no longer applied to the guaranteed amount. The form value is then calculated as a decreasing life insurance, in which the life insurance is the “remaining cash refund” which is calculated by subtracting cumulative annuity payments from the initial guaranteed amount determined as of the benefit commencement date.

Cumulative annuity payments are calculated by summing the following two items:

-

Cumulative annuity payments prior to year of death.

-

Annuity payments in the year of death, adjusted for an approximate UDD (uniform distribution of death) assumption.

Note that if the payment form is temporary, the cash refund will expire at the end of the temporary period. Therefore, the payment form will be considered N/A for commencement dates for which the temporary period is not sufficient to pay out the guaranteed benefit prior to the payment expiration. In addition, the form value of the payment of the cash refund upon member death is always valued assuming the refund is paid at the end of the year of death, regardless of the payment timing selected under Plan Attributes.

If the payment form has a deferral period, the full value of the guaranteed amount is paid to the beneficiary if the member dies during the deferral period.

The present value can be represented formulaically as the present value of the single life annuity plus the present value of the guaranteed amount (as a decreasing life insurance). The formula below breaks the present value of the guaranteed amount into the part attributable to any deferral period and the part attributable to commencement of the annuity.

Where:

x = age on determination date,

r = age when benefit commences,

w = age when probability of death becomes 100%,

t = number of years from determination date,

Adj = payment frequency adjustment (see Present values: benefits payable (m)thly for details)

Annuityt = annuity payable at time t,

Guarantee = amount, as of the date of decrement for active participants, guaranteed to be paid,

Guaranteer = amount guaranteed to be paid as determined at the date the annuity commences,

is = interest rate applied during the deferral period at time s, and

Adjmcr = payment form adjustment for guaranteed amount,

for beginning of period annuity payments and

for end of period annuity payments, where m is the number of annuity payments made during the year.

For an example of a refund annuity see FAQ-Computing refund annuities.

Joint refund annuity with balance paid after both participant and beneficiary die

The joint refund annuity payment form is typically used by contributory pension plans in which a plan participant’s contributions (typically with interest) are due to his/her beneficiary(ies) in the event both the participant and beneficiary die before receiving all of the contributions in the form of annuity payments. In ProAdmin, this guaranteed amount is entered in the payment form as a Benefit Formula Component.

If the beneficiary receives 100% of the annual benefit amount upon the death of the member, then the total payment form value at any commencement date is the sum of the following values:

-

The value of the 100% joint and survivor annuity payment, contingent on the joint lives of the member and beneficiary.

-

The value of the lump sum payment for any remaining cash refund, contingent on the member’s death only if he/she dies after their beneficiary.

-

The value of the lump sum payment for any remaining cash refund, contingent on the beneficiary's death only if he/she dies after the member.

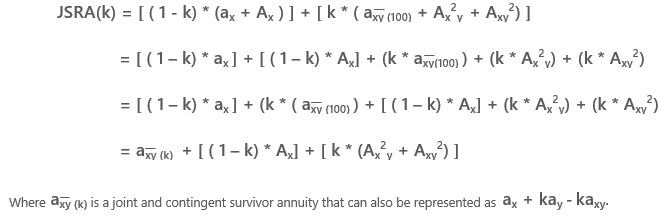

If the beneficiary receives less than 100% of the annual benefit amount upon the death of the member, then the total payment form value at any commencement date is a blending of a standard single life modified cash refund annuity and a 100% joint cash refund annuity:

JSRA(k) = [ (1 - k) * RA ] + [ k * JSRA(100) ]

Where:

k = percent of the annual benefit paid to the beneficiary upon the death of the member,

JSRA = joint cash refund annuity,

RA = single life modified cash refund annuity

The following develops the calculation formula used in the detailed results development for joint refund annuity payment forms:

Consequently, if the beneficiary receives k% of the annual benefit amount upon the death of the member, then the total payment form value at any commencement date is the sum of the following values:

-

The value of the k% joint and contingent survivor annuity payment, contingent on the joint lives of the member and beneficiary.

-

The value of the lump sum payment for any remaining cash refund, contingent on the member's death, multiplied by one minus k.

-

The value of the lump sum payment for any remaining cash refund, contingent on the member’s death only if he/she dies after their beneficiary, multiplied by k.

-

The value of the lump sum payment for any remaining cash refund, contingent on the beneficiary's death only if he/she dies after the member, multiplied by k.

Note that when k=0%, the calculation is simply a standard single life modified cash refund annuity.