The effective duration is displayed in the Valuation Set exhibits when an Interest Sensitivity Set is run (and includes interest rates as a sensitivity) and consistent for all valuations included in the final event of the Valuation Set. Note that the absolute value of the high and low sensitivities must be the same (e.g. low sensitivity is -0.001 and high sensitivity is +0.001) for the duration to be calculated.

ProVal uses the formula below to calculate the effective duration:

For funding, the calculation uses the Actuarial Liability as specified in the Asset and Funding Policy (Not-at-risk liability for PPA law type in U.S. Qualified mode) for all actuarial cost methods except Entry Age Normal. In U.S. public pension and OPEB modes, the funding liability effective duration is only available when the liabilities are not rolled forward from an earlier calculation date.

For accounting, duration is calculated under ASC 715, IAS 19, and CICA 3462 accounting standards based on the PBO (APBO for OPEB mode). When the accounting measurement date is after the valuation date, the effective duration is calculated using the liability as of measurement date.

Plans with interest-sensitive cashflows

For plans where benefit payment amounts vary with the interest rate, changes in the underlying payments can be accurately captured by including the interest crediting rate and/or conversion interest valuation assumption in the Interest rate Sensitivity Set.

As an example, take a cash balance plan with a fixed 4% annual interest crediting rate and annuity conversion interest rate that is equal to the valuation interest assumption of 6.25%. When calculating effective duration for this plan, the low interest and high interest sensitivities should reflect an analogous change in the annuity conversion interest rate. The Interest Sensitivity Set defined in the Valuation assumption sensitivities screen includes both the interest rates and conversion factors interest valuation assumptions.

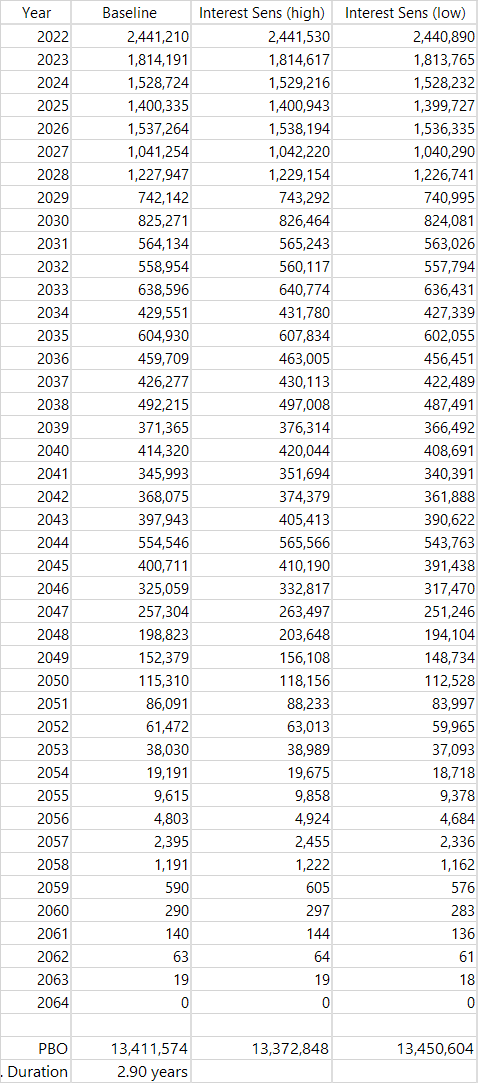

The high interest sensitivity calculates the underlying benefit payment stream using an annuity conversion rate of 6.35% (6.25% + 0.10%) and then discounts those benefit payments using a valuation interest rate of 6.35%. Similarly, the low interest sensitivity calculates the underlying benefit payment stream using an annuity conversion rate of 6.15% (6.25% - 0.10%) and then discounts those benefit payments using a valuation interest rate of 6.15%. The PBO projected benefit payments and effective duration calculation for this plan are in the table below. In this example, the duration would be much larger if the conversion interest assumption was excluded from the Interest Sensitivity Set.

PBO benefit payments and effective duration calculation: