The #DECSTOP operator carries out a specific type of attribution for Projected Unit Credit and Unit Credit methods. In this method, the benefits for decrement in the next N years beginning on the valuation date (where N is the left argument of the DECSTOP operator) are treated as fully attributed on the valuation date, and the benefits for decrement at all other ages are treated as not attributed as of the valuation date. Further, the benefit for decrement N+1 years from the valuation date is treated as not attributed on the valuation date, and fully attributed one year from the valuation date (and therefore brings about a Normal Cost).

The operator is useful for calculating P.U.C. and U.C. liabilities and normal costs for particular death and disability benefits that are partially funded through participant premiums, each year’s premium advancing the coverage period from N to N+1.

For example, you might use the formula:

3 #DECSTOP ComponentName

to exclude benefits funded by premiums beyond 3 years from the valuation date for actives (or beyond 3 years from the year of termination for Terminated Vesteds) from the PUC liability, but include them in the PVFB.

Syntax:

N #DECSTOP Formula

Tip:

When setting up a benefit formula containing the #DECSTOP operator, setting a temporary variable equal to the right argument of the operator may be helpful when viewing the sample life results.

Example:

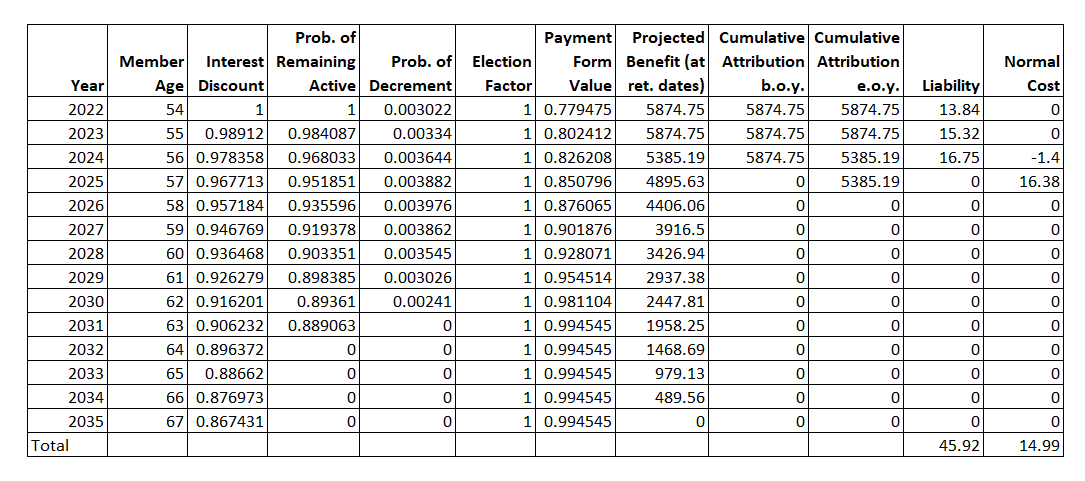

Assume the above benefit formula:

3 #DECSTOP ComponentName

The cumulative attribution at beginning of year will be zeroed out for decrement ages in the forth year after the valuation date and beyond. The cumulative attribution at end of year benefit will be zeroed out for decrement ages in the fifth year after the valuation date and beyond.

Note that the above adjustment is made only under the Unit Credit and Projected Unit Credit methods, and only if accrual rate proration is used. No adjustment is made if using a unit credit method with linear proration.