QUESTION 1: My client has an implicit Pension Equity Plan. The formula is based on final average pay, where participants accrue a percentage of final average pay for each year of service based on their age at the time of accrual. Upon termination of employment, the participant’s annual benefit payable at age 65 is the sum of the annual earned percentages multiplied by final average pay and then divided by a deferred to age 65 annuity factor. Percentage points are prorated during calendar years when participants age into another age bracket. Ages are measured in completed months. The percentages are:

Annual Percentage

of

Final Average PayAge Percentage Under 30 3% 31-35 4% 36-40 5% 41-45 6.5% 46-50 8% 51-55 9.5% 56-60 11% 61-65 14% Over 65 16%

How can ProAdmin be coded for this benefit?

ANSWER 1: In ProAdmin, Pension Equity (PEP) plans are coded using the Accrual-Career average Benefit Formula Component type. (In ProVal there is a special accrual definition type for PEP plans, but this is not needed, and thus not available, in ProAdmin because its special features have to do with the calculation of the normal cost for funding and accounting.) The Accrual-Career average Benefit Formula Component type will accumulate the final average pay percentage values every year. In addition, we will need Benefit Formula Components for final average earnings and a deferred annuity, as well as a subformula to bring everything together. The chart below summarizes the components.

Benefit Formula Component Example Names Description Accrual - Career average

Sum_of_Percentages Accumulation of annual percentages Accrual - Basis only

Final_average_pay Final average pay Annuity Factor

Def_65 Deferred to age 65 annuity factor Subformula

PEP_fomula The accrued benefit for PEP

Using the example names above, the components are parameterized as described below:

- Sum_of_percentages

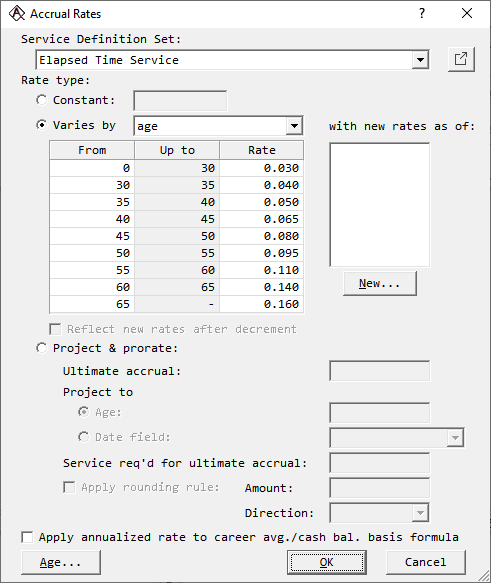

- Enter the values in the Accrual Rates dialog as follows:

- Uncheck the Apply annualized rate to Career Avg./cash bal. basis formula box.

- Set the Basis Formula to 1 (one) so just the rates control the accruals.

- Set the Accrued Benefit to the Expected value. Unclick the checkbox for rounding.

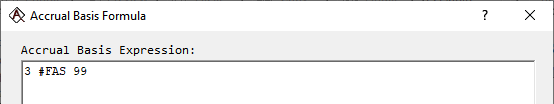

- Final_Avergae_Pay. Use ProAdmin's default final average salary operator: 3 #FAS 99.

- Def_65 annuity.

- Select the plan's actuarial equivalence mortality and interest rates.

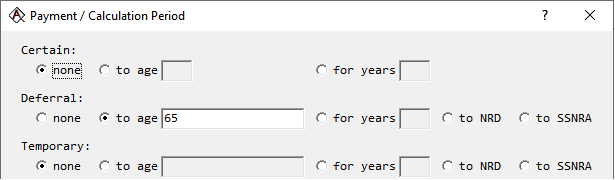

- Defer the annuity to age 65 on the Payment / Calculation Period dialog:

- For Age / Interpolation, use the plan's default age definition, if it is applicable, otherwise select or define a new one.

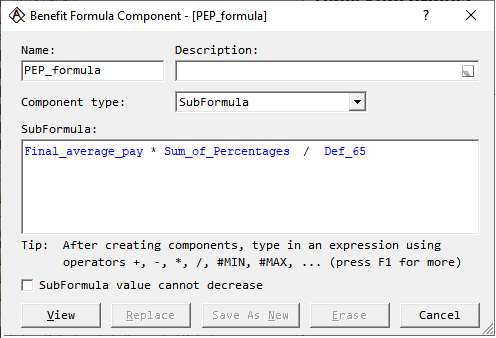

- PEP_formula is the Sum_of_Percentages * Final_Avergae_Pay / Def_65. The detailed output for this component will show the accumulation of the percentage points.

ANSWER 2: Since interest is added from termination date to age 65, the annual benefit at age 65 is produced by adding interest to the amount at termination and using an immediate age 65 annuity factor as the divisor. This amount is the accrued benefit payable at age 65. The steps are:

- Code the first two steps as above.

- Introduce a new Benefit Formula Component of type Interest Factor. In this component, use a constant interest rate of 0.06; keep Mortality rates as <none>, and Apply interest Compound to Normal Retirement Date from Decrement. We call this component "Interest_to_65".

- We also compute an immediate annuity factor for age 65 and beyond.

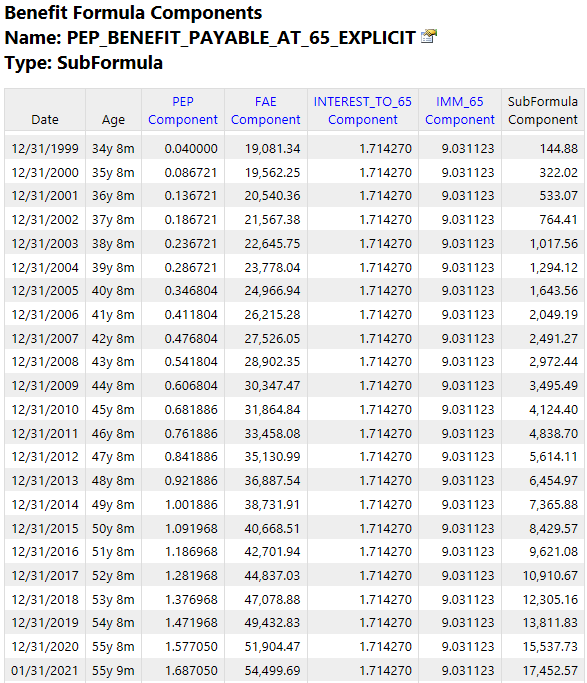

- Finally, compute the annual benefit in a subformula: PEP * FAP * Interest_to_65 / Imm_65.

Illustrative detailed results are shown below for the subformula component, showing the details of each of the building block components.