QUESTION: My plan is cash balance. Its normal form is a lump sum. Participants may take a partial lump sum of 25% of the cash balance amount and the rest as an annuity. There are several optional forms of the annuity. How do I compute relative values for the optional forms?

ANSWER: ProAdmin has a convenient feature that allows you to sum the values of pieces of the total benefit to calculate the correct relative value, where each potential piece of the benefit is its own Benefit Definition. Accordingly, the approach detailed below assumes that you have the following three Benefit Definitions:

- Cash balance - The Benefit Formula is the cash balance Benefit Formula Component. Its normal (and only) form of payment is a lump sum.

- Partial lump sum - The Benefit Formula is 0.25 x the cash balance. Its normal (and only) payment form is a lump sum.

- Partial annuity - The Benefit Formula is 0.75 x the cash balance. Its normal form of payment is a lump sum and there are annuity optional forms.

To calculate the relative value:

- Enter the Plan Definition Relative Value Calculations topic and check Calculate lump sum equivalent for payment forms. Select the relative value actuarial equivalence assumptions and age definition (which is typically the same age method as used to determine optional forms).

- Check Display relative value, check Use alternative normal form (denominator), and click the Normal Form Params button. For Benefit Definitions "Partial annuity" and "Partial lump sum," in the Normal Form Benefit Definition column, select

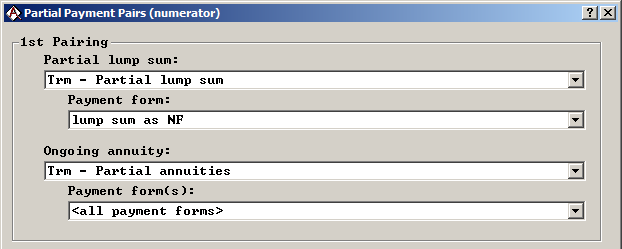

the "Cash balance" Benefit Definition. Leave the Cash balance as "<same> ." Click OK. Thus, the Cash balance Benefit Definition represents the total value of the benefit, so it is the denominator for relative value calculations. - Check Reflect partial payments (numerator) and click the Partial payment pairs button. We will need only one partial lump sum pairing. The "Partial lump sum" Benefit Definition (with its single lump sum payment form) will be added to all of the payment forms of the "Partial annuity" Benefit Definition to make the numerator of the relative value calculation. Thus, if a member selects a partial lump sum with a partial annuity, the values of these two payment forms will be added together and compared to the value of the full cash balance to determine the relative value.

After a calculation has been performed, the summary results for the three Benefit Definitions will be as follows:

- Cash balance: the only payment form shown will be the lump sum, and its relative value will be 1.

- Partial annuity: the normal form of payment is lump sum (75% of the cash balance amount). The other payment forms are displayed as primary amounts with beneficiary and change date values. The LS Equiv. column contains the optional forms amounts converted into lump sums using relative values assumptions. The Rel. Val. column shows the optional forms plus the partial lump sum relative to the total lump sum. [ (LS Equiv. +partial lump sum)/total lump sum.]

- Partial lump sum: the only payment form shown will be the lump sum (25% of the cash balance amount). This amount is included in the numerator of the relative value results for the Partial annuity, so the Rel. Val. column for this Benefit Definition will be blank.