QUESTION: How do I code ProAdmin for IRC Section 436 prohibited payments?

ANSWER: Internal Revenue Code Sections 436(d)(1) and 436(d)(3) limit the amount to be paid from a defined benefit plan for accelerated payments (such as lump sums, Social Security Level Income benefits and certain annuities) when the adjusted funding target attainment percentage (AFTAP) is under 80%. The AFTAP is certified by the plan’s actuary each plan year. Prior to a certified AFTAP being available, the presumed AFTAP determined in accordance with IRC Regulation 1.436-1(g) is applicable. The optional forms calculations will be based on one of three scenarios:

| 1 | AFTAP < 60% | No accelerated payment forms are allowed. |

| 2 | AFTAP >= 60% & AFTAP < 80% | Half of the values of accelerated payment forms are allowed (up to the PBGC maximum benefit guarantee amount). The other half can be a non-accelerated form. |

| 3 | AFTAP >= 80% | All payment forms are allowed. |

Before attempting any coding, it is necessary to determine which of the plan’s optional forms potentially fall under the definition of restricted (accelerated) payment forms under IRC Section 436 and the regulations thereunder. Accelerated payment forms include lump sums, Social Security leveling options, life insurance and some period certain annuities. Mandatory cash outs of $5,000 and under are not accelerated payments.

Coding approaches for several Section 436 scenarios are detailed below. An Illustrative client file that includes this coding is available from ProAdmin technical support.

There are several ways to approach coding ProAdmin for Section 436. One way that is appropriate for lump sum payment forms is to define 3 sets of Benefit Definitions, one that will be payable when benefits are unrestricted, and one each for the restricted forms and the balance of the benefit when restrictions are in place:

-

Set up a numerical array field (“AFTAP”) and define it as the value provided by the plan’s actuary (e.g. 75% funded is represented by 0.75) for each plan year or portion thereof.

-

Create a copy of the restricted (typically lump sum) forms of payment and modify their Eligibility criteria such that the form is only payable when the AFTAP is at least 80%.

-

Create a copy of the normal form of payment and modify its Eligibility criteria such that it will never be payable (e.g., set the eligibility to age 100 with 100 years of service). (This allows the form of payment to be used for actuarial equivalence within a Benefit Definition without being made available to the user as an election choice.)

-

Create a copy of the Benefit Definition(s) to offer only the accelerated (typically lump sum) payment forms when the 50% restriction is in place:

-

Modify the Eligibility Requirements to reflect that the AFTAP is at least 60% and less than 80%, such as by appending the following to the Selection Expression in the current Eligibility Requirements :

#AND [(0.6 <= AFTAP) #and (AFTAP < 0.8)]

-

In the Benefit Formula, multiply the accrued benefit by 50%. (If it’s possible for the accrued benefit to exceed 200% of the PBGC maximum benefit guarantee amount, then modify the benefit to be the lesser of 50% of the accrued benefit and the PBGC maximum benefit guarantee amount, as discussed later in this document.)

-

Modify the included Payment Forms by deleting all of the non-restricted payment forms, including the normal form of payment.

-

Add the copy of the plan’s normal form made in step 3 above, and make this the Benefit Definition Normal Form (for actuarial equivalence calculations).

-

Modify the payment forms included in the original Benefit Definition(s) to replace the restricted payment forms with the copy made in step 2 above, so that when the AFTAP is less than 80%, all of the restricted forms of payment will be suppressed. Thus, this version of the Benefit Definition(s) will always produce optional forms of payment at 100% of the accrued benefit, but will only offer accelerated payment forms when they are unrestricted.

-

Create a third copy of the Benefit Definition(s) to offer only the non-restricted companion forms of payment when a benefit is bifurcated:

-

The Eligibility Requirements would be the same as in step 5(a) above, reflecting that the AFTAP is at least 60% and less than 80%.

-

The Benefit Formula should generally multiply the accrued benefit by 50%. If the accrued benefit might exceed 200% of the PBGC maximum benefit guarantee amount, the benefit formula should be the accrued benefit minus the lesser of (1) 50% of the accrued benefit and (2) the PBGC maximum benefit guarantee.

-

Only the non-restricted payment forms should be included

-

If a calculation is run with these sets of 3 Benefit Definitions and the AFTAP is between 60% and 80%, the results will facilitate a participant choosing a 100% of accrued benefit non-restricted form of payment (from the step 5 Benefit Definition) or one of the 50% restricted-form benefits (from the step 4 Benefit Definition) along with one of the 50% companion benefits (from the step 6 Benefit Definition). If a calculation is run and the AFTAP is less than 60% or at least 80%, results will be only be produced from the step 6 Benefit Definition, with the restricted forms only calculated if the AFTAP is at least 80%.

PBGC Maximum Benefit Guarantee Amount

When accelerated payment forms are restricted, Section 436 allows half of the accelerated forms to be paid up to a maximum of the value of the PBGC maximum benefit guarantee amount. The PBGC publishes annually a table of age-based maximum lump sum amounts applicable to benefits commencing during the calendar year. Below is an approach, using the #GETTABVAL operator to look up the maximum, to incorporate this maximum into the determination of restricted lump sum payments in ProAdmin.

-

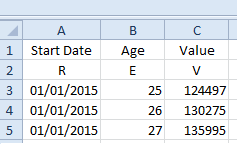

Create a CSV file (e.g., PBGC_max_PV.CSV) with three columns from the annual present value amounts provided by the PBGC:

-

Start Date - use January 1 of the calendar year as the starting date; Indicator = R (range)

-

Age; Indicator = E (exact)

-

Value; Indicator = V (value)

-

-

Create a Salary Definition and a Salary Definition Set (e.g., PBGC_max_PV) where the transformation expression develops the maximum lump sum payable from the CSV file created in step 1.

-

The salary transformation expression (reflecting that the maximum is initially effective 1/1/2008) will be:

date := [(#DATE <= 12/31/2008) * (1/1/2008) ] + [(#DATE > 12/31/2008) * #DATE] &

age := #INT (#DATE #YEARDIF DateOfBirth) &

‘PBGC_max_PV’ #GETTABVAL (date,age)

-

Define the Stopping salary to Stop salaries at the adjusted stopping date and then stop the salary at the later of Decrement, and set the Stop date adjustment to a Date Adjustment library entry parameterized as #BCDATE 1 (the last benefit commencement date). This ensures that the appropriate maximum is reflected for each benefit commencement date.

-

- Create a Salary Custom Operator (e.g., #PBGC_max_PV) using the Salary Definition Set created in step 2.

-

Set the Salary limit to <none>.

-

Check the box to Reflect salary after decrement (rather than freezing at decrement).

-

- Create a basis-only Accrual Definition benefit formula component (e.g., PBGC_max_PV), where the expression is the Custom Operator created in step 3: #PBGC_max_PV

-

Create a Subformula benefit formula component, (e.g., Restricted_PV_fraction) to determine the fraction of the accrued benefit that may be payable as a lump sum. The subformula would be developed as follows:

-

Calculate Lim_Ben as the plan benefit (assumed to be a component called PlanBen) limited to the 415 Maximum benefit:

Lim_Ben := #MAXBEN 0 #MIN PlanBen &

-

Multiply the limited benefit by an appropriate annuity factor to calculate the present value of the plan benefit:

PV_ben := AnnFactor * Lim_ben &

-

Calculate the maximum benefit as the lesser of the PBGC maximum and half of the present value of the plan benefit:

Max_LS := (PV_ben * 0.5) #min PBGC_max_PV &

-

Calculate the restricted payable fraction as the maximum lump sum divided by the present value of the limited plan accrued benefit:

fraction := Max_LS / PV_ben &

-

The value for the fraction is only necessary when the AFTAP is greater than 60% and less than 80%:

fraction * [(AFTAF >= 0.6) #and (AFTAF < 0.8)]

-

Modify the Benefit Definition for the restricted lump sum to (1) limit the accrued benefit by #MAXBEN 0 and (2) multiply it by the fraction calculated in step 5.

-

Modify the Benefit Definition for the part of the accrued benefit that cannot be paid as a lump sum to (1) limit the accrued benefit by #MAXBEN 0 and (2) multiply it by one minus the fraction calculated in step 4.

Non-Lump Sum Optional Forms

The examples in IRC Regulation §1.436-1(d)(3)(v) illustrate the application of the Section 436 rules to certain non-lump sum accelerated forms of payment. In each case it is necessary to determine whether or not the acceleration is permissible (because it represents no more than the lesser of 50% of the value of the accrued benefit or 100% of the PBGC maximum benefit guarantee amount). If the acceleration is determined to not be permissible, the plan may offer half of the accrued benefit under the accelerated form with the balance of the accrued benefit under an alternative, non-accelerated form of payment.

To do this in ProAdmin for a Social Security Level Income (SSLI) option, for example, it is necessary to evaluate the optional form directly within its own Benefit Definition when the AFTAP is at least 60% but less than 80%:

-

Create a Subformula benefit formula component that returns 1 if the SSLI option is restricted and 0 if it is not (e.g., SSLIRestricted). The SSLI option is restricted if the present value of the excess of the temporary benefit over the deferred benefit (which is the assumed Social Security amount unless the deferred benefit is $0) exceeds the lesser of the PBGC maximum guarantee amount and one half of the value of the normal form of benefit (see IRC Regulation 1.436-1(d)(3)(v), Example 3). Here is an illustrative subformula applicable for actuarial equivalence conversion subject to 417(e) minimum actuarial equivalence:

PVAccBen := Planben * ( LA_Plan #max LA_RV ) &

DefBen :={[ PVAccBen #ZMINUS (PIA * TempLA)] / LA } #MAX 0 &

TempBen :=[( DefBen = 0 ) * ( PVAccBen / TempLA )] +

[( DefBen <> 0) * ( DefBen + PIA )] &

Max := PBGCMax #Min (.5 * PVAccBen) &

Restricted:=(AFTAP<.8) #AND

{[(TempBen - DefBen) * TempLA ) > Max}

-

Create a copy of the Benefit Definition to offer only the SSLI payment form when it is not restricted.

-

Modify the Benefit Formula to multiply the plan benefit by 1 if the form is not restricted using the subformula created in step 1, such as:

PLANBEN * #NOT SSLIRestricted

-

Delete all optional forms except the SSLI form.

-

Add the copy of the plan’s normal form made in step 3 of the Lump Sum Optional Forms section above, and make this the Benefit Definition Normal Form.

-

Create a copy of the Benefit Definition in Step 2 to offer only the SSLI payment form when the 50% restriction is in place:

-

Modify the Eligibility Requirements to reflect that the AFTAP is at least 60% and less than 80%.

-

Modify the Benefit Formula to multiply the plan benefit by .5 and then by the SSLIRestricted subformula created in step 1, such as:

PLANBEN * .5 * SSLIRestricted

-

Modify the main Benefit Definition as discussed in step 5 of the Lump Sum Optional Forms section above (so that when the AFTAP is less than 80%, all of the restricted forms of payment will be suppressed).

-

Remove the SSLI payment form from this main Benefit Definition. Because of the special treatment needed to determine if it is restricted or not, the SSLI needs its own restricted and not-restricted Benefit Definitions.

-

Thus, this version of the Benefit Definition(s) will always produce optional forms of payment at 100% of the accrued benefit, but will only offer accelerated payment forms (excluding the SSLI form) when they are unrestricted.

-

Include the Benefit Definitions described in step 6 of the Lump Sum Optional Forms section above.

-

If a calculation is run with these sets of 4 Benefit Definitions (6 if the plan also offers lump sums over $5,000) and the AFTAP is between 60% and 80%, the results will facilitate a participant choosing:

-

A 100% of accrued benefit non-restricted, non-SSLI form of payment (from the step 4 Benefit Definition), or

-

The SSLI form of payment on the entire accrued benefit if it is not restricted (from the step 2 Benefit Definition), or

-

The SSLI form of payment on one-half of the accrued benefit when it is restricted (from the step 3 Benefit Definition) plus one of the 50% restricted-form benefits (from the step 4 Benefit Definition) along with one of the 50% companion benefits (from the step 5 Benefit Definition).

Plan Alternative for Special Optional Forms

IRC Regulation §1.436-1(d)(6) discusses the possibility of a plan having a different set of optional forms available only when the restrictions of Section 436 are in place. Should this scenario apply, separate Benefit Definitions would be defined for the with and without restrictions scenarios, with the eligibility requirements reflecting the current level of the AFTAP.